Not known Details About Property By Helander Llc

Not known Details About Property By Helander Llc

Blog Article

6 Simple Techniques For Property By Helander Llc

Table of ContentsAn Unbiased View of Property By Helander LlcWhat Does Property By Helander Llc Mean?How Property By Helander Llc can Save You Time, Stress, and Money.The 6-Second Trick For Property By Helander LlcGetting The Property By Helander Llc To WorkFacts About Property By Helander Llc Uncovered

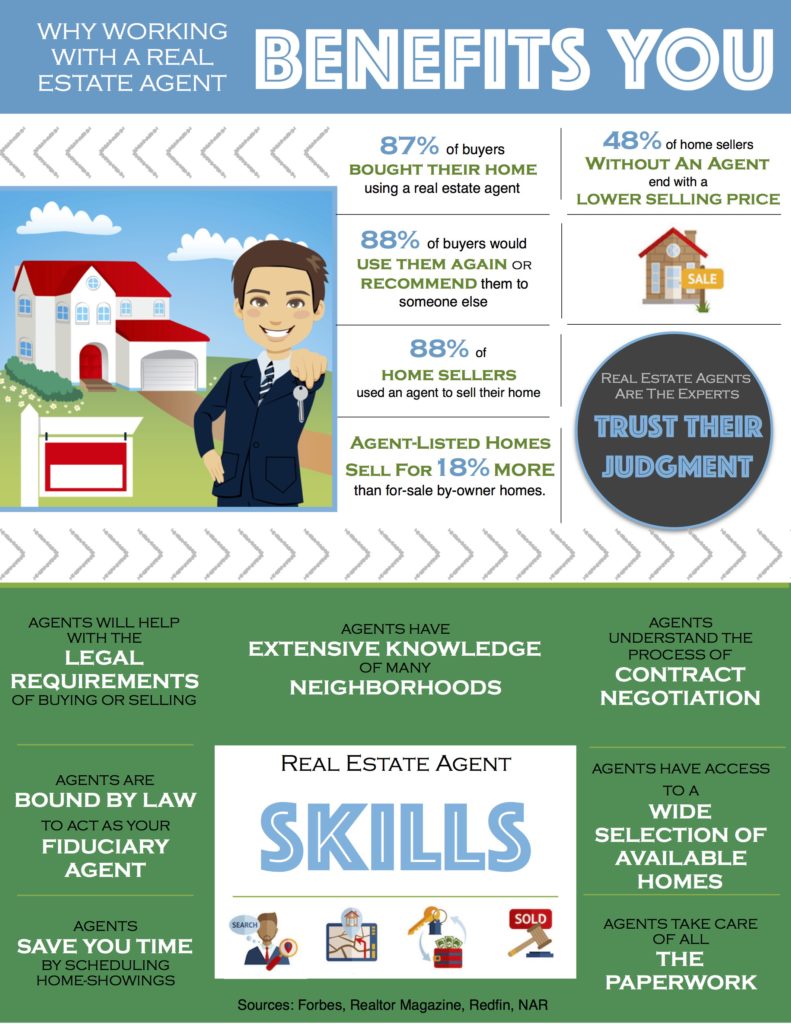

The advantages of spending in genuine estate are countless. Here's what you require to recognize about real estate benefits and why real estate is thought about an excellent financial investment.The advantages of purchasing genuine estate consist of passive earnings, steady cash money circulation, tax advantages, diversity, and leverage. Genuine estate investment trusts (REITs) use a method to spend in genuine estate without having to own, operate, or financing properties - (https://www.reddit.com/user/pbhelanderllc/). Capital is the take-home pay from a property investment after home mortgage settlements and business expenses have actually been made.

Oftentimes, money circulation just strengthens gradually as you pay for your mortgageand construct up your equity. Investor can capitalize on countless tax obligation breaks and reductions that can conserve cash at tax obligation time. As a whole, you can subtract the reasonable costs of owning, operating, and handling a residential property.

What Does Property By Helander Llc Do?

Property values have a tendency to boost with time, and with an excellent investment, you can turn a profit when it's time to market. Rents additionally have a tendency to increase in time, which can lead to greater cash circulation. This chart from the Reserve bank of St. Louis reveals median home costs in the U.S

The areas shaded in grey indicate united state recessions. Median List Prices of Houses Marketed for the USA. As you pay down a property mortgage, you construct equityan possession that belongs to your total assets. And as you develop equity, you have the take advantage of to acquire even more residential or commercial properties and enhance capital and wealth a lot more.

Because realty is a tangible property and one that can act as collateral, financing is readily offered. Genuine estate returns differ, depending on elements such as location, property course, and administration. Still, a number that several investors aim for is to defeat the ordinary returns of the S&P 500what lots of people describe when they say, "the market." The rising cost of living hedging ability of realty stems from the favorable connection in between GDP growth and the need genuine estate.

The Ultimate Guide To Property By Helander Llc

This, in turn, translates right into higher resources worths. Genuine estate has a tendency to keep the purchasing power of capital by passing some of the inflationary stress on to renters and by including some of the inflationary stress in the form of capital appreciation. Home loan financing discrimination is prohibited. If you believe you've been differentiated against based on race, faith, sex, marital condition, use of public assistance, national beginning, handicap, or age, there are steps you can take.

Indirect property investing entails no direct possession of a residential property or properties. Rather, you purchase a swimming pool together with others, wherein an administration company possesses and runs properties, or else owns a profile of home loans. There are a number of ways that having realty can secure versus rising cost of living. Residential property values might increase higher than the price of inflation, leading to capital gains.

Ultimately, residential properties funded with a fixed-rate financing will see the family member quantity of the monthly mortgage repayments tip over time-- for example $1,000 a month as a fixed settlement will become less burdensome as inflation wears down the buying power of that $1,000. Typically, a primary home is not thought about to be a realty investment given that it is used as one's home

Excitement About Property By Helander Llc

Even with the help of a broker, it can take a couple of weeks of job just to find the right counterparty. Still, real estate is a distinct property course that's basic to comprehend and can improve the risk-and-return account of an investor's profile. On its very own, real estate offers money flow, tax obligation breaks, equity building, affordable risk-adjusted returns, and a hedge against rising cost of living.

Buying property can be an unbelievably fulfilling and profitable endeavor, yet if you resemble a great deal of brand-new capitalists, you may be wondering WHY you need to be purchasing realty and what benefits it brings over various other investment chances. In addition to all the fantastic advantages that occur with purchasing actual estate, there are some disadvantages you require to consider also.

The Basic Principles Of Property By Helander Llc

At BuyProperly, we utilize a fractional possession design that allows investors to begin with as little as $2500. Another significant advantage of real estate investing is the ability to make a high return from buying, remodeling, and marketing (a.k.a.

Most flippers look for undervalued buildings in structures neighborhoodsFantastic The fantastic thing concerning spending in real estate is that the worth of the property is anticipated to value.

Indicators on Property By Helander Llc You Need To Know

For example, if you are charging $2,000 lease each month and you sustained $1,500 in tax-deductible expenditures each month, you will just be paying tax obligation on that particular $500 profit monthly. That's a huge difference from paying taxes on $2,000 each month. The revenue that you make on your rental for the year is taken into consideration rental earnings and will be tired as necessary

Report this page